How many responses you need for your research efforts can vary depending on a number of factors. For most market and communications research, we utilize sample partners who have millions and millions of registered research participants. You may have an easy to reach target where the sample company has all kinds of availability for your target audience, or you may have a target that is harder to reach where there are only so many responses available. Figuring out the feasibility and cost of the respondents you need can often be the first step in determining how many responses you will shoot for in your research.

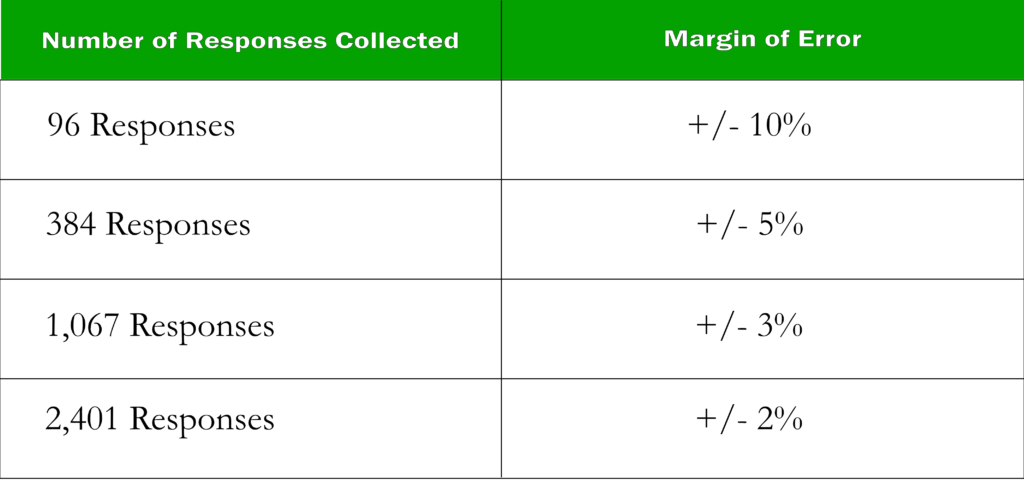

Here is a quick chart for reference when determining statistical representation based on the total population of the U.S. These same numbers would be applicable to most total populations for research. Margin of error is the measure we use to determine statistical accuracy. The more surveys you collect, the smaller your margin of error. What this number tells us it that for example if we were to collect the same number of responses twice, our percentages are 95% likely to stay within these ranges.

Sample size calculators are available for free in many places. Click Here for one.

The number of responses one collects is always situational. Here are 3 examples we run into on a weekly basis.

Example #1: The bountiful availability of U.S. Homeowners

If your target is the general U.S. consumer, chances are you can count on as many responses as you need, and usually for under $5.00 a response. With this example, the only thing you need to figure out is how many responses you would like and how much statistical representation your budget can accommodate.

Example #2: The elusive C-Suite of fortune 500 companies

Maybe you need to evaluate your reputation and communication message awareness for an elite group of executives. Upon first look at a request like this, I would automatically assume these contacts were not readily available and statistical representation is going to have to take a backseat to getting ANY data we can. An online survey is out of the picture as the rate of response would be too low. Chances are, you are going to need the names and phone numbers of these folks as phone interviews are going to be necessary. In this case, your best course of action is going to be designing and implementing a qualitative study aimed at getting as many responses as possible. Incentive structure recommendations for this group would be a charitable donation in the area of $200 to $500 per response.

Example #3: Surveying our membership

Let’s say you have your own internal contact list for your organization. This is a much different situation than collecting data from panel respondents, or a harder to reach target. For this example let’s assume you have a list of updated email contacts, and you have 2,000 total. You have determined that you would like to reach a minimum of 400 contacts to ensure that you have a margin of error of around +/- 5%. In order to do this, you are going to need a 20% response rate from your contact list. These days, with surveys being so common, I would definitely make sure you have an incentives budget for your study. Without an incentive most client-supplied contact lists will not yield more than a 5% response rate. The cost of someone’s time may well exceed what you would pay for panel sample. In many cases the value paid out for each response can be anywhere from $10 to $20. For business-to-business audiences this could go up to $40-$50 per survey. Those costs add up quick and need to be factored in when you are using your own contact list and establishing how many contacts you need for your research to be successful.

As always, we hope this was helpful. If you ever have questions about your research, our mission is to help, offer advice, and offer any services you might need to meet your goals. Feel free to get in touch! info@growthsurveysystems.com .

-Nate